If there’s one moment that can cause an insurance agent to freeze up, it’s when there’s an insurance rate increase. That’s because most agents don’t actually have a plan for what to do when this happens. This can cause agents to feel tense or anxious, and result in some awkward interactions with clients. After an insurance rate increase, agents may feel like they’re going to lose clients, and that they need to jump into problem-solving mode, to get out of the situation as quickly as possible.

“I wanna take some time and just rewire our brain. We don’t necessarily need to jump into problem-solving mode. We need to jump into conversation mode. So how can we have an adult professional conversation about rates?” (1:13)

If there’s one moment that can cause an insurance agent to freeze up, it’s when there’s an insurance rate increase. That’s because most agents don’t actually have a plan for what to do when this happens. This can cause agents to feel tense or anxious, and result in some awkward interactions with clients. After an insurance rate increase, agents may feel like they’re going to lose clients, and that they need to jump into problem-solving mode, to get out of the situation as quickly as possible.

So, how can we fix this core problem that comes up time and time again in our field? Having specific next-steps ready is key to making sure you can sail smoothly through insurance rate increases. Here are some to get you started:

Slow down and have a conversation

When we experience an insurance rate increase, our default mode may be to think about how upset the client will be, and assume they’re going to leave us. But if we slow down for a moment, take a deep breath, and initiate a conversation, we can actually come to the best conclusion for our client. That’s because plenty of different scenarios could trigger a rate increase, ranging from the carrier, to claims, or a discount falling off. Simply starting the dialogue with “Let’s have a conversation about rate” will allow you to open up the floor to discuss why this happened, and what the best next-steps are. This follows our idea that slowing down to speed up is key to being a Ridiculously Amazing Agent, or that slowing down allows you to work more effectively overall.

Have trust in your skills to make an assessment

As an insurance agent, you are not only in the business of insurance sales, but you’re also in the position of guiding and educating your clients. You are the expert in the situation, and that’s why your client is turning to you. Most individuals don’t have a thorough understanding of their insurance coverage, and that’s why your role is so valuable. Trust in your own skills and expertise to make an assessment. This will allow you to educate your client, and empower them to make the choice that is best for them.

Don’t instantly fall back on remarketing

Remarketing may be your instant go-to when a rate increase happens, but it should really be the last tool in your toolkit. That’s because remarketing is really the most labor-intensive tool, and it doesn’t always solve the problem.

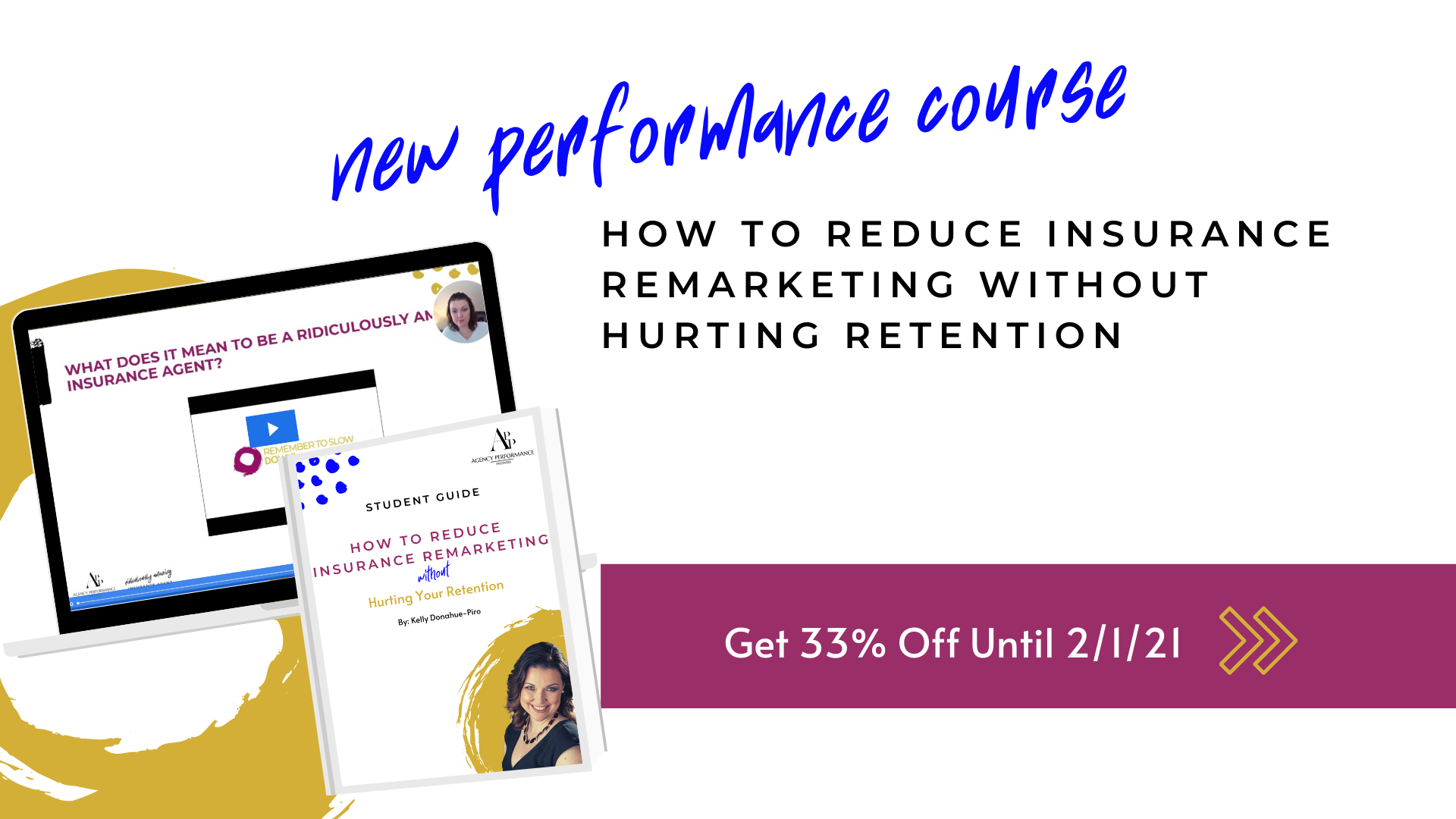

While it makes sense why there can be anxiety around insurance rate increases, it’s up to you to set yourself up for success when this happens. If you’re looking to end these situations with less remarkets and improve your retention, our newest course provides you with all you need to know to excel at conversations around insurance rate increases.

Follow Us on Social Media

Follow us on social media to get a daily dose of our 3 Minute Videos, to help you on your journey to becoming a Ridiculously Amazing agent. We share our videos on Youtube, Instagram, Facebook, Twitter and Linkedin.