Could your team use examples of good customer service in insurance? We all could, right? For many agencies, service is hard to track and manage. Let’s face it, everyone’s version of WOW customer service is different.

For me, texting makes my life easier. For my mom, it’s getting prompt return phone calls. I have learned from listening to thousands of insurance customer service calls; many agents get the job done, but many consistently miss the WOW factor.

Some clients may get WOWed, but the average client who calls every 2-3 years may not get that personalized and warm experience you may be thinking of.

In this blog, we cover examples of WOW customer service strategies that Agency Performance Partners is helping clients install into their process and embrace.

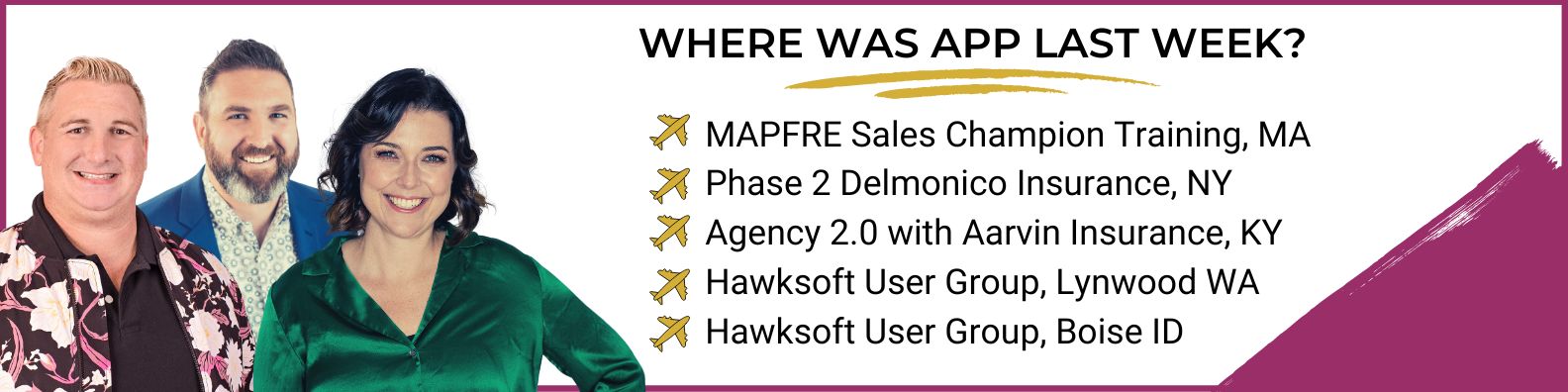

APP Update

The Challenge With Tracking Insurance Customer Service

It’s challenging to track your customer service if you can’t measure it. By nature, customer service in insurance has always been a bit harder to handle. There are several variables. However, the statement that you can’t manage what you can’t measure is true. With the advent of new insurance technologies, we can get more indicators of your team’s customer service.

Let’s outline several top ways to track your team’s service before we dive into the strategies you need.

Recorded Phone Calls

Most phone providers today offer call recording. While each state varies as far as alerting the caller, this is a powerful tool that your agency can embrace (in fact, it often can lower your E&O insurance as well). Stepping away from a call and listening objectively for coaching will bring immense value to your team. In addition, this is an excellent training tool for new team members to hear some great phone calls.

Online Reviews

Getting online reviews helps with so many other agency challenges (such as organic SEO search rankings). Most people will not proactively leave a review for their independent agent – unless they are not delighted, and then you have another situation on your hands. Targeting and asking for feedback is an excellent way to keep a pulse on your customer service.

Net Promoter Score

Polling and surveying your clients is a great way to get feedback. Some clients may not be comfortable calling in with a concern. You can’t fix what you do not know about. Using the net promoter score, you get regular and consistent feedback across departments and team members that you can use to provide valuable training.

Retention Rate

Insurance agency retention rate can be challenging to track; however, it is not impossible. Learning how your agency’s management system suggests following retention will help you understand how happy your clients are. We recommend monitoring policy, premium, revenue, department, and person retention.

Average Policies Per Client

One great way to check if your team’s service is on track is to watch to see if the policies per client are increasing or decreasing. Happy clients are looking to spend more with you, not less.

Team Morale

Many studies show that a happy team gives better service. When your team has the right tools, training, and empowerment, they treat your clients differently. You want to limit internal friction and find ways to determine the team’s stress and frustration levels. An empowered team means better service.

6 Examples of Good Customer Service In Insurance

The key to giving good customer service in insurance is consistency. As you review this you may be thinking we do this sometimes. The idea of good customer service is a consistent approach. Review these strategies but then think what percentage of time are we really doing this?

A Memorable Phone Greeting

Your phone greeting is the first impression. When my team calls an agency and hears a less than enthusiastic greeting we get excited. This agency needs us! In many agencies, the phone ringing is an interruption when it should be why we exist.

Great phone greetings should include the following:

- A positive and warm tone of voice – the person should be happy to pick up the phone and greet the caller

- A consistent greeting that is memorable (see below for some options)

- The call receiver should pull up the account and confirm you have the right client

- Confirmation of what the caller is looking for to get them to the best person to help them (note this is not always the person they are asking for)

- A warm transfer to the best person to assist them

We love a great phone greeting. Everyone in the agency should answer the phone the same way.

Phone Greetings

Before you read our recommended greetings, you should identify that an awesome greeting is something different and gets a client into a comfortable state of mind.

- Thank you for calling AGENCY NAME, how can we make this the best call of your day?

- It’s a great day at AGENCY NAME, how may I direct your call?

If your cheese meter is up, that’s ok. The idea is that the caller is impressed off the bat. It’s a great day at… is an excellent phone greeting because you cannot say it without smiling. This ensures that your agency clients always get greeted with a smile. If you are still unsure, try it for 10 days. What do you have to lose?

Limit Back & Forth With First Call Resolution

Read more in this blog: How Convenient is Your Agency?

Most clients do not want to deal with their insurance; they do so because they have to. When they call in, they want an efficient and effective process. Customer service agents who embrace headsets and limit taking down client notes on a notepad can engage in first call resolution. With first call resolution, you complete the caller’s request from start to finish, including documenting your agency management system.

First call resolution helps agents give good customer service because:

- You get all the information you need to complete the request

- Avoid missing a detail or trying to read messy handwriting

- The proposal is fully completed and off the client’s to-do list

- You can discuss any changes in premium with the client

- While on the phone, you can conduct a mini review and build rapport with the client

The more time you spend with the client, the deeper the relationship

Customer Service Insurance Agents Celebrate Life or Business Changes

We just purchased our first family new vehicle ever. The car dealership and finance manager were all kissing our behinds. My husband was told at least five times how good he looked in the truck. When someone is buying a house, car, getting new employees or equipment, we need to celebrate that with them. That includes talking to them about the purchase and showing you genuinely care. Most of these life events represent a premium increase. When you celebrate the change with the client, they build a special bond with your agency.

“We see our customers as invited guests to a party, and we are the hosts. It’s our job to make the customer experience a little bit better.” – Jeff Bezos, Founder Amazon

Good Customer Service In Insurance Requires Documentation

Details and documentation are part of every service professional’s role. There is simply no way you can remember the details of hundreds of customers. Since most customers will only talk to their agent every 2-3 years, documenting accounts is critical. In addition, we may be assisting another caller or at lunch – when the client calls in, they deserve to have anyone be able to pick up and help them.

The great resignation has impacted many agencies. This means that books of business are moving around, and new hires are getting onboarded. When the notes on an account are non-existent or unclear, it negatively impacts your team morale and customer service experience. We recommend all agencies embrace a documentation strategy that is audited and adopted.

Showing True Gratitude

It’s no secret that clients have choices on their insurance. One way to show your client’s appreciation for choosing your agency and staying at your agency is to show true gratitude. True gratitude is not simply saying thanks. It’s taking the time to acknowledge your client.

Think about it would you be shocked if the following happened:

- Your mortgage company called and thanked you for your loyalty and on-time payments

- Your grocery store took the time to say thank you for shopping here weekly

Yes! You would.

We can take our clients for granted, and a short statement of gratitude goes a long way. Here is how we coach agents in our Customer Service Training Program:

“I noticed you have been a client of ours for 5 years. I wanted to say thank you for your loyalty. Helping people like you with insurance is what we love. Thank you for your business.”

Clients May Not Like Insurance, But They Can Like You

We had a situation where my husband’s Mustang Race Car was being dropped from the carrier because it was a little too race car-like. We received this news via a short email. This email had no plan – just good luck. When I contacted the agency owner and the account notes were reviewed a different story became apparent.

The customer service representative escalated the matter all the way to the head of underwriting. She advocated and fought on my behalf. She literally did everything she could, it was actually impressive. Where she missed the customer service mark is that she didn’t share that with me, the client. Remember, people do not know what you do not tell them. When you advocate for a client, share with them what you are doing – they may not like the outcome, but they can like you.

“Don’t dwell on what went wrong. Instead, focus on what to do next. Spend your energies on moving forward toward finding the answer.”

– Denis Waitley, Author and Motivational Speaker

Making Recommendations and Educating Clients

Most of the best examples of good customer service in insurance stem from education. Insurance is complicated, and clients often don’t care about insurance until they need it. However, we can change that dynamic by being educators and having the heart of a teacher.

Great teachers take the opportunity to educate clients.

When a client calls into an agency they’ve made the to talk about insurance. In fact, insurance is on their mind. Offering a quick review of their insurance or making a recommendation on coverage can go a long way. We often get into transaction mode rather than relationship mode on service calls.

Let these common, simple items soak in as you start educating your clients vs. asking rote questions:

- Payment options

- Deductible check

- New endorsements

- Payroll confirmation

- Review additional lines of insurance

- Check on current coverages and see if there are any amendments

Next Steps

Good customer service in insurance is intentional, it’s not left to chance. Top agencies invest in training their team so customer service is delivered consistently and flawlessly. When you think about Disney, Chick-Fil-A and Nordstrom all of them take the time and make the investment in training their team on customer service strategies.

If your agency needs assistance with executing fearlessness and flawlessness, APP is here to deliver.